Have you ever considered opening a Health Savings Account (HSA) but felt unsure whether it aligns with your financial and healthcare needs? Our previous blog highlighted different ways you can use your tax refund to help progress on your financial goals, including funding an HSA. Because this is a popular subject, we decided to write a whole blog on HSAs to give you greater insight into HSAs and provide insights that could aid in making a well-informed decision regarding the suitability of an HSA for your situation.

If you want to learn other options for investing your tax refund, refer to our recent blog on Strategies for Your Tax Refund.

What is a Health Savings Account (HSA)?

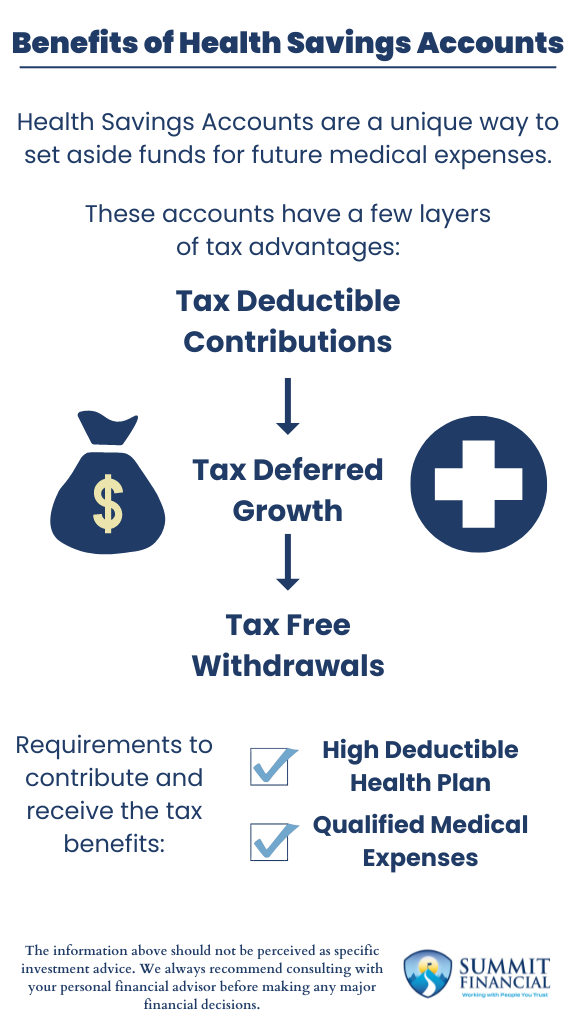

Health Savings Accounts are a unique way to set aside funds for future medical expenses. You can fund these accounts on your own directly through an HSA provider, but some employers also offer to contribute on an employee’s behalf.

For the year 2024, the total amount that can be contributed to an HSA is $4,150 for an individual or $7,750 for a married couple or family. It’s important to note that this limit applies to the household, and both employer and employee contributions combined must remain within this limit. The contribution limits for these tax-advantaged accounts may vary yearly as the IRS sets new guidelines.

Tax Advantages of Health Savings Accounts

We believe the tax advantages of Health Savings Accounts are attractive and can be one option to potentially improve your financial plan. HSAs include what we like to refer to as a “Triple Tax Benefit,” and these benefits are as follows:

- Contributions to an HSA are tax deductible. Employer contributions to an HSA are not taxable as income for the employee. Any contributions the household makes on their end are deducted from their income for tax purposes. This means the money going in is considered pre-tax after the deduction is taken. This is one strategy to consider to reduce the income taxes you owe.

- Growth within the account is tax deferred. Some HSA providers may allow you to allocate savings to investments such as stocks, bonds, ETFs, or mutual funds, while others only allow you to hold cash within the account. In either case, the growth or interest in the account is tax-deferred and does not result in income or capital gains while the funds remain within the account.

- Withdrawals are tax-free if used for qualified medical expenses. Examples of these qualified expenses may include medical bills, prescription costs, and potentially even insurance premiums, depending on your type of coverage. These accounts are meant for health expenses, so the government can potentially tax and penalize withdrawals made for other purposes.

Limitations of Health Savings Accounts

One limitation of an HSA account is the requirement for medical expenses, which will eliminate some of the tax advantages of these solutions.

The other main limitation is that the household must be enrolled in a High-Deductible Health Plan (HDHP) to qualify for an HSA and fund the account. These HDHP plans have certain aspects that make them HSA eligible, including a deductible above the IRS-set level and a cap on the out-of-pocket expenses allowed under the health plan. This can be a roadblock for some households since those enrolled in a great health plan with low deductibles will not be eligible.

If your employer offers multiple health plans to choose from, the best coverage option may not be HSA-eligible, so this should be considered if you are hoping to fund an HSA.

For further reading, consider our guide on the basics of health insurance, offering foundational knowledge to navigate your healthcare options effectively.

Deciding if a Health Savings Account is Right for You

- Health Savings Accounts are a unique way to set aside funds for future medical expenses.

- These accounts have a few layers of tax advantages since the contributions are tax-deductible, gains in the account are tax-deferred, and withdrawals are tax-free if they are used for qualified medical expenses.

- Health savings accounts have some limitations, including the requirement for a high-deductible health plan and the potential for taxes and penalties if the funds are not used for medical expenses.

Speak With a Trusted Advisor

Navigating the intricacies of HSAs, alongside broader financial planning and investment strategies, can be complex. If you have any questions about health savings accounts, your investment portfolio, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please call us so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Estate Planning for Blended Households

- Flexible Side Hustles

- Examining Pre-Tax and Post-Tax Contributions

Sources: