Pensions are a luxury that very few pre-retirees are still being offered today. Most employers are shifting away from pensions because these retirement benefits create a large strain on the company’s cash flow. However, if you have a lump sum vs. pension decision to make before retirement, this could be one of the toughest choices of your life.

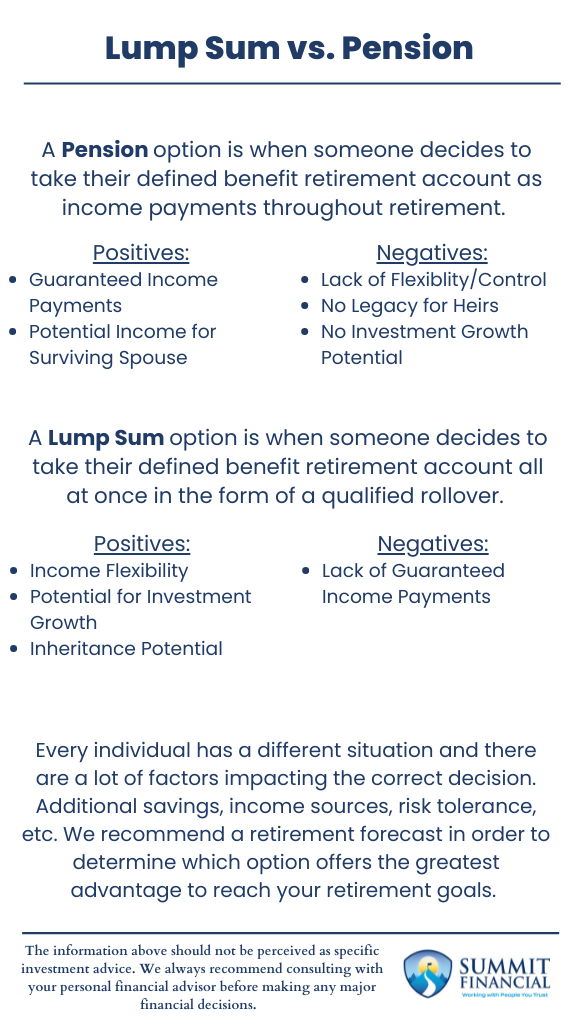

Which option you select will surely have a huge impact on your retirement lifestyle and the probability of not outliving your retirement assets. This blog attempts to help explain the pros and cons of each option as well as the process we go through to determine the best route for our clients.

Understanding the Lump Sum Option

Those who are offered a pension are usually offered a one-time lump sum option as well. This means that the defined benefit retirement account can be paid out all at once in the form of a qualified rollover. These rollovers are usually transferred to an IRA to avoid income taxation at the time of the lump sum transfer. Income taxes will be due when funds are withdrawn from the account throughout retirement.

Pros and Cons of Choosing a Lump Sum

The positives of the Lump Sum option include flexibility, outperformance potential, and inheritance potential. Flexibility refers to the concept that you are free to do as you please with the lump sum funds. You can spend, invest, gift, etc. the funds that are received from the lump sum. The assets are under your control and this allows you to be flexible with your retirement budget and withdrawals.

The lump sum option also may be a larger benefit over time if the assets are invested and earn a modest return. Investing the funds allows them to grow at a rate that may outpace inflation or any COLA rider on the pension. This provides the lump sum the potential to outgrow the collective pension payments. Lastly, a lump sum will allow you to pass on any remainder to your heirs. If inheritance is a strong goal of yours, then this may make the lump sum option more attractive.

The biggest downside to the lump sum option is the lack of recurring payments. Retirement income from these assets must be withdrawn from the retirement account, and these withdrawals are not guaranteed for life. If the account value is depleted, then it may become difficult to sustain the individual’s standard of living throughout retirement. This means the lump sum option is typically better suited for higher-risk individuals who may not need the guaranteed income stream of the pension.

Understanding the Pension Option

If you are offered a pension, you normally have a handful of options to choose from. You can have the benefits expire when you pass, you can have the benefits continue for a surviving spouse in various increments, and sometimes you can elect a period-certain benefit.

By having the benefits expire when you pass, this creates the largest income benefit during your lifetime. Obviously, if any portion of the benefits are elected to continue for a surviving spouse, then the benefits you will receive will be reduced.

The greater the benefit for the spouse, the greater the decrease for the insured individual while they are still alive. Period certain means the pension is guaranteed to be paid out over a set number of years (usually 10 years), and if you pass before the end of the timeframe, then the full benefits will be paid to a surviving spouse until the end of the period.

Pros and Cons of Choosing a Pension

The greatest advantage for the pension option is the reassurance of guaranteed income. Pensions provide an income stream throughout retirement that can be used to cover monthly expenses. Pensions are great for individuals who are lower risk and like the financial peace of mind of guaranteed payments.

Pensions are also ideal for those who have consistent monthly budgets and do not expect to need random sums of money to pay for sporadic expenses.

The downside to the pension is the lack of freedom that comes with it. Unlike the lump sum, you do not control the assets that are used to fund the pension. This means that you do not invest the account balance nor is there any potential to leave an inheritance for your heirs.

You can invest and save any excess pension payments, but that is the most you can do for growth potential. Your surviving spouse may receive a pension benefit if you elect the spousal option at retirement, but there is no benefit for your children or other heirs once you pass away. Unless you have other assets set aside, a pension is not going to provide an inheritance for you to pass on.

Conclusion: Deciding Which Option is Right for You

Of course, every individual’s situation is different, so we cannot use a blanket strategy when making recommendations for these types of decisions. Factors we typically consider are the client’s retirement lifestyle preference and budget, risk tolerance, inheritance goals, whether additional retirement savings are available, and more.

Also, every lump sum and pension option scenario is different. We normally see the annual pension payments around 3-5% of the total lump sum amount, but that is not always true. Sometimes, individuals are offered above a 5% payout, and sometimes, they are offered below a 3% payout.

We take all these factors into consideration when analyzing our client’s potential options. Most importantly, we use a program called Retire Up to help us illustrate the impact the options available. To do this, we input all the retirement info we have for the clients into our system, and the result is a forecast of the retirement outcome and likelihood of success.

By keeping all variables the same, except for the pension and lump sum benefits, we can isolate these choices and help determine mathematically which route makes the most sense. However, sometimes, our clients side with their personal preferences on the option instead of choosing the best option mathematically. This is totally fine as long as our retirement illustration is still successful.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found our article helpful, consider reading our other recent posts on Bull vs. Bear Market, Record Inflation, and Fiduciary vs. Financial Advisor.