In a recent blog post, we discussed how the Federal Reserve is using monetary policy tools to address inflation in the United States.

One key approach has been raising interest rates to slow economic activity, which can help reduce demand for goods and services. In turn, this lower demand may contribute to easing inflationary pressures.

If you haven’t read our previous post, we encourage you to review it for a more in-depth explanation.

How Mortgage Interest Rates Affect Borrowing Costs

The Federal Funds Rate is the rate that banks are charged by the U.S. government to borrow funds, so a higher rate means the money would be lent to businesses and consumers at a higher rate as well.

If the funds are more expensive for the banks, then they will be more expensive for anyone trying to get a loan from that bank.

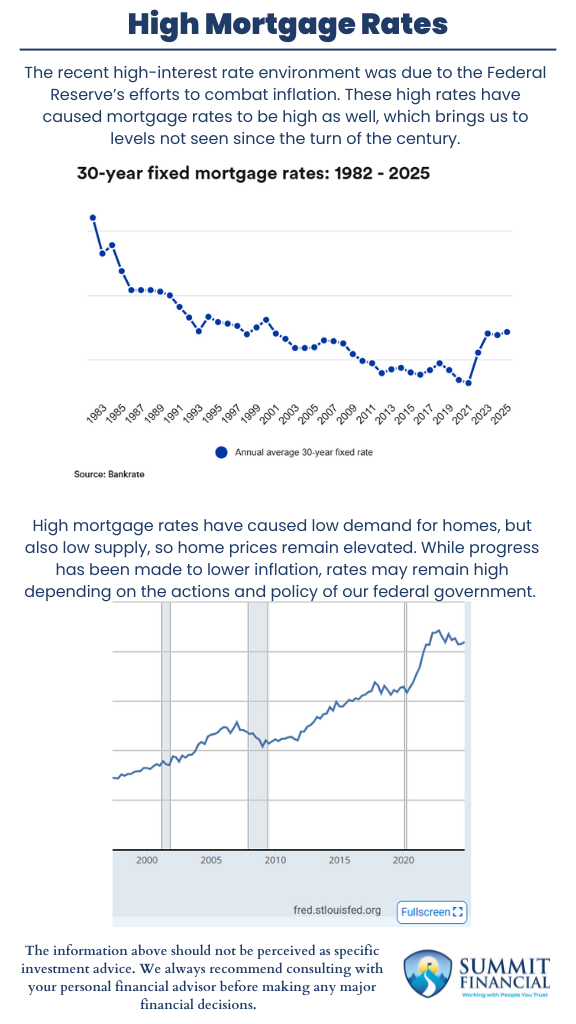

This includes mortgages as well, which are at levels not seen since the turn of the century. Over the past couple of years, the annual average mortgage rate has been hovering around 7%, which has not been seen since 2001.

Why Are Existing Home Sales Declining?

These higher rates have caused homes to become more expensive since a higher rate leads to a higher monthly mortgage payment. We believe these higher rates are a large factor as to why existing home sales have been trending lower over recent years.

This data is currently at levels not seen since 2010, after the financial crisis. We believe those who were able to lock in a very attractive rate in 2020 and 2021 will be hard-pressed to want to sell their home and sacrifice their low rate.

So, not only do we have buyers who do not want to take on a higher-rate loan, but we also have potential sellers who are holding their current home to keep their current rate.

Why Are Home Prices Are Staying High Despite Low Demand?

This lack of existing homes for sale could also be a factor leading to the higher home prices we have seen in recent years.

The lack of demand for new homes could lead to lower home prices, but there is also a lack of supply that is potentially causing prices to remain elevated. So high prices and high rates may be causing buyers to remain on the sidelines for now.

The Federal Reserve has recently started lowering interest rates, so we might see mortgage rates come down, which may make monthly payments more affordable.

However, the other side of that coin is that lower rates may cause an increase in demand for homes, which may drive prices higher at the same time. Home prices do not reverse very often, so this could be a potential downside to waiting for lower rates to buy a home.

Is It Better to Buy a Home Now or Wait for Lower Interest Rates?

If you are able to afford a home with the current interest rate environment, then it may be a reasonable consideration to purchase now rather than wait.

If interest rates do come down then you would get the home at a potentially lower price before the increased demand hits the market. Also, you could always refinance the mortgage to a lower rate at that point too.

One phrase that we use is, “You can refinance the rate on the mortgage, but you cannot refinance the purchase price of the home.”

How Inflation and Federal Policies Could Impact Future Mortgage Interest Rateses

One thing we want to mention is that this forecast depends heavily on the progress made on inflation. This will be impacted by the actions and policies of the federal government. If inflation manages to come down, then interest rates may follow accordingly.

However, President Trump recently announced aggressive tariffs on international imports, which may cause prices to be higher for consumers.

In other words, tariffs may lead to more inflation, which then may cause rates to remain elevated. Because of this uncertainty, we always recommend consulting with your financial advisor before making any significant decisions.

They can help you assess your current situation and discuss what level of monthly payments may be affordable for your mortgage details.

Key Takeaways on Mortgage Interest Rates and Home Affordability

- The recent high-interest rate environment was due to the Federal Reserve’s efforts to combat inflation.

- These high rates have caused mortgage rates to be high as well, which brings us to levels not seen since the turn of the century.

- High mortgage rates have caused low demand for homes, but also low supply, so home prices remain elevated.

- While progress has been made to lower inflation, rates may remain high depending on the actions and policy of our federal government.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker.

If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink and James Baldwin

If you found this article helpful, consider reading:

- How Do Bull Markets and Bear Markets Differ

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Tax Filing Explained

Sources:

- https://www.cnbc.com/2025/01/08/mortgage-rates-hit-highest-level-since-july-crushing-application-demand.html

- https://www.businessinsider.com/personal-finance/mortgages/average-mortgage-interest-rate

- https://summitfc.net/federal-reserve-interest-rate-policy/

- https://www.bankrate.com/mortgages/historical-mortgage-rates/

- https://www.mortgagenewsdaily.com/data/existing-home-sales

- https://fred.stlouisfed.org/series/MSPUS

- https://www.reuters.com/markets/us/feds-collins-says-fed-can-be-patient-rates-amid-tariff-uncertainty-2025-02-03