By now, you’ve probably heard the story about the historic “short squeeze” of GameStop’s stock. While many successful investors profit when stocks rise in value, some investors bet on the opposite—profiting from a stock’s decline in value.

As a result, Short Selling is an appealing strategy to some traders but too high a risk for others.

How Does Short Selling Work?

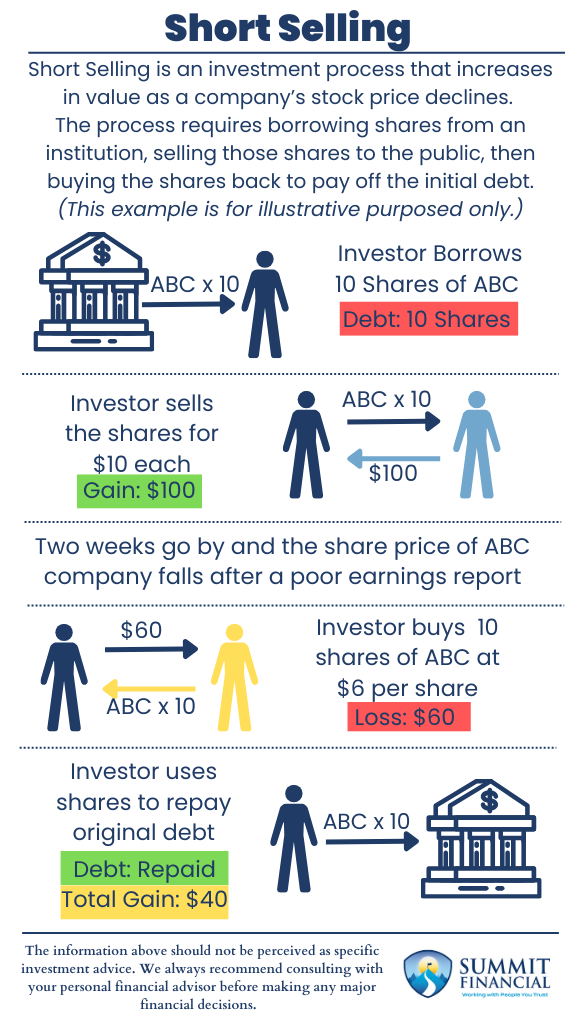

- Short Selling is an investment process that increases in value as a company’s stock price declines.

- Short Selling requires borrowing shares from an institution, selling those shares to the public, and then buying the shares back to pay off the initial debt.

- The required purchase of stock to close out the short sale is what may sometimes lead to a Short Squeeze.

The average investor in the stock market buys a position (stock, ETF, mutual fund, etc.) with the hopes that the price of the investment will increase. The traditional idea is to invest in hopeful and trustworthy companies that will provide a positive rate of return.

But what if you think a company is going to fail and possibly go bankrupt? You obviously do not want to bet on the company’s success, but how do you bet on the company’s failure? The solution we believe you may want to consider is Short Selling.

The Benefits of Short Selling

So, what is Short Selling then? We will use the example below to illustrate the idea in simpler term:

- Investor A borrows 10 shares of ABC company valued at $10 each from their brokerage firm. Total debt is 10 shares.

- Investor A sells these shares on the open market and receives the $10 per share ($100 total)

- Two weeks go by and the share price of ABC company is now $6 per share.

- Investor A buys 10 shares of ABC company for $6 each ($60 total) and pockets the remaining $40 as profit.

- Investor A then uses the newly acquired shares to pay off the original debt to the brokerage firm.

The Risks of Short Selling?

The process may sound appealing, but there are major risks associated with this strategy. There is limited upside available within the short sale since the lowest a stock can go is $0, so the most potential for a short sale is the current dollar value per share.

The most a company can lose is their current value. However, on the other hand, a company can grow and grow and grow all the way to an infinite size. This means that a short sale has unlimited downside available. If the stock keeps going up, the short sale will continue to lose money.

In order to close out the short sale and walk away, you must repay the original amount of shares borrowed. If a stock continues to rise, then you will be forced to buy the shares back at a higher price in order to pay off the debt. Short selling is a very aggressive and risky strategy, so it should only be utilized by those comfortable with the risk and with non-essential savings.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

Sources:

- https://www.investopedia.com/ask/answers/how-does-one-make-money-short-selling/

- https://www.nerdwallet.com/article/investing/shorting-a-stock

- https://www.investopedia.com/articles/basics/06/invest1000.asp#:~:text=Investing%20in%20stocks%20can%20be,in%20gains%20on%20your%20investment