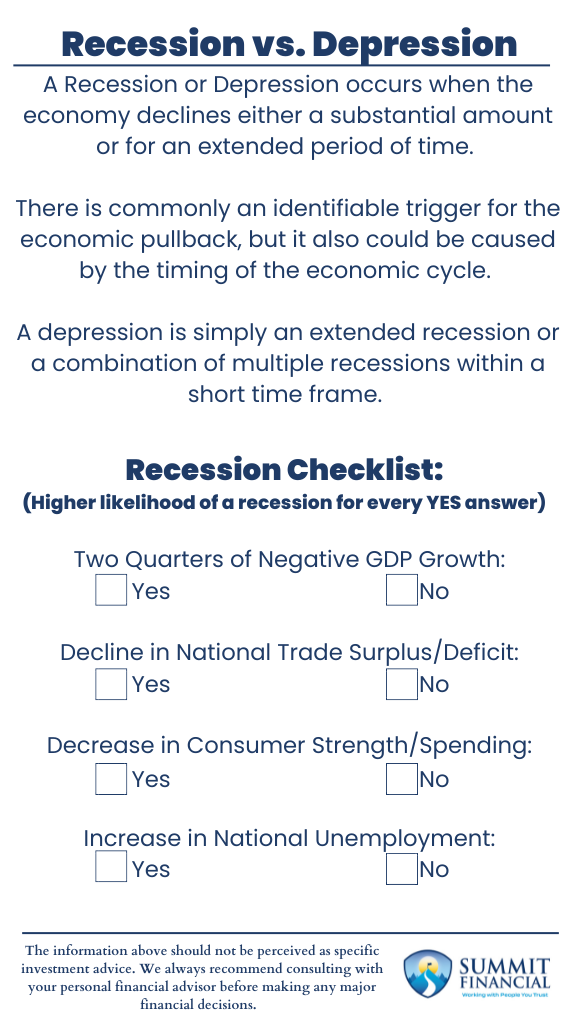

- A Recession or Depression occurs when the economy declines either a substantial amount or for an extended period of time.

- There is commonly an identifiable trigger for the economic pullback, but it also could be caused by the timing of the economic cycle.

- A depression is simply an extended recession or a combination of multiple recessions within a short time frame.

There have been more and more rumors of a potential economic recession coming for the United States. A recession is when the economy experiences a slowdown in an array of data or indicators, such as production or employment.

We recently posted a blog detailing how rate of change can be used as part of an economic analysis, and this concept is helpful in understanding the economic cycle. Please check it out if you have not yet!

The Economic Cycle

Essentially, the economy goes through a rollercoaster-type pattern. It is a series of ups and downs that create peaks and troughs over time. The recession/depression risk occurs when the economy makes a cycle top and then heads down toward the cycle bottom. Not every top-to-bottom move causes the economy to enter a recession or depression, though. This economic cycle and the rate of change data allow investors to understand when the risk is becoming larger or smaller and allows analysts to adjust their forecasts for the future. So what are the requirements for a recession then?

Unfortunately, the answer is not very clear since every analyst or economist has their own opinion as to what constitutes a recessionary or depressionary environment. It is much easier to identify these instances in the rearview mirror and much harder for people to identify before or during the slowdown. However, there are a handful of commonly agreed-upon characteristics.

The Characteristics of a Recession

Negative GDP Growth: The most common rule of thumb is that a recession occurs when the economy experiences two-quarters of negative GDP growth. This means the country-wide growth needs to be actually heading backwards for two consecutive quarters. This would equate to a reduction in the amount of goods/services sold within the economy.

Trade Surplus/Deficit: A component could be the nation’s trade surplus and deficit as well and the rate of change in international trade. A trade surplus is when a country exports more than it imports, and a deficit is more imports than exports. You can tell a country might struggle when they manage to go from a surplus to a deficit or from a larger to smaller surplus or a smaller to larger deficit.

Consumer Spending: The consumer is another big factor in a recession since the economic slowdown will be visible on the household level. A slowdown in consumer spending means that the average household is spending less because they either have less money or their purchasing power has declined due to a weak currency or high inflation. If consumers are not able to spend as much as they were, then the lack of spending will surely hurt corporations and the overall economy. Unfortunately, a company is likely to consider reducing their workforce if they are struggling to generate a profit.

Unemployment: Unemployment is another key factor of a recession since a strong economy requires more workers, and a weak economy will cause layoffs and hiring freezes. This can potentially create a vicious cycle as consumer spending slows, companies make less, and they lay off some staff, so consumer spending decreases even further, and the cycle continues until an economic bottom is formed.

Triggers of a Recession

There is typically a trigger that causes a recession or depression, but the underlying economic setup is usually visible in hindsight. For example, the great financial crisis was caused by the collapse of the housing bubble that was created/triggered by large Wall Street firms. Up until the collapse, the economy was roaring, and nobody was concerned about what could potentially happen next. It wasn’t until consumer debt reached unimaginable levels that investors were buying into mortgage-backed securities heavily, then homeowners couldn’t make their payments, and the entire system collapsed like a domino effect. The bursting of the bubble was the trigger that caused the recession, but the economy was peaking before we reached that point.

It is not common for a recession to occur in an economy that is already experiencing slow growth. It’s not impossible for a recession to develop on its own during the economic cycle, but typically there is an underlying catalyst that causes the ordinary slowdown to become extraordinary.

The Difference Between a Recession and a Depression

The difference between a recession and a depression can be hard to see in real time. It is not until after the slowdown that the difference may become clear to economists. A Depression is simply a recession that occurs for a longer period of time and is usually to a greater extent as well. The U.S. economy has actually only experienced a single depression, and this was the Great Depression of the early 1940’s. In fact, many would argue this depression was just two recessions that occurred within a short time frame. A Depression is normally expected to last for more than a year or two, and a recession is a temporary slowdown in the economy. Both are bad for the nation and the citizens, but a depression can be much worse with much longer lingering effects afterward.

Speak With a Trusted Advisor

If you have any questions about changes for 2023, your investment portfolio, taxes, our 401(k)-recommendation service, or anything else in general, please give our office a call at (586) 226-2100. Also, please feel free to forward this commentary to a friend, family member, or co-worker.

If you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please contact us so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink.

If you found this article helpful, consider reading:

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Debt Repayment Strategies

- How to Negotiate a Raise

Sources: