The process of Roth conversions is a very popular topic when we are speaking with clients. We have seen that a common goal among our client base is to pay as little as possible in taxes to the federal government throughout their retirement. Performing a Roth conversion allows you to shift assets from a pre-tax retirement account into a post-tax retirement account with the primary goal of paying the taxes now rather than later.

We reviewed the differences between Traditional and Roth accounts in our previous blog and also dove into the process behind Roth conversions in this post.

Taxability of Social Security Benefits

While it may be beneficial to perform Roth conversions, we feel the need to mention a few areas of consideration beyond income tax brackets.

First, we have seen that most conversions occur during retirement, and the client may or may not be receiving their Social Security benefits. This is important because, at a base level, Social Security benefits are not taxable, then 50% of the income may be subject to income taxes, and then up to 85% may be taxed (IRS.gov).

This means that performing Roth conversions could cause more Social Security benefits to become taxable, which would counteract some of the benefits of the initial conversion. This does not mean that Roth conversions while collecting Social Security should never happen, but it does mean that more analysis may be needed to ensure it is still adding value to a retirement plan.

Health Insurance Premiums and Income Implications

Next, Roth conversions could cause you to report a higher income, and this could impact the costs of your health insurance premiums.

- For those who retire before age 65 and need individual coverage, they may be able to qualify for reduced costs through the Premium Tax Credits if their income is low enough (healthcare.gov).

- If your income is already too high to qualify for assistance, then additional income via Roth conversions may not impact your premiums.

- However, for those who are 65 or older and are on Medicare, they may be subject to higher premiums due to a higher income (ssa.gov).

Once again, these considerations should be analyzed before performing Roth conversions, since you may end up having to pay more for health insurance, which would counteract some of the potential tax savings from the conversions.

Considering Beneficiary Tax Rates

Lastly, it is important to consider the beneficiaries’ potential tax rate for any inheritance they may receive. We believe one of the main goals behind our client’s desire for Roth conversions is to leave a tax-free inheritance to their beneficiaries.

However, Roth conversions may hinder an inheritance, and it is possible that the beneficiary may be able to receive a larger net inheritance if they received pre-tax monies and paid the taxes at their lower tax rates rather than the higher rate of the original owners.

For example, if the beneficiary has a lower income and is in a married 10% bracket, but the original owner is single and wants to convert up to the 24% bracket, then it might be more beneficial to delay the tax payments until after the beneficiary inherits the monies.

This part of a retirement plan is hard to estimate and forecast, especially if the client plans to live another 20+ years, but it is still a topic of conversation we feel the need to have with our clients to ensure they are well informed before performing Roth conversions.

Roth Conversions in Retirement- Key Takeaways

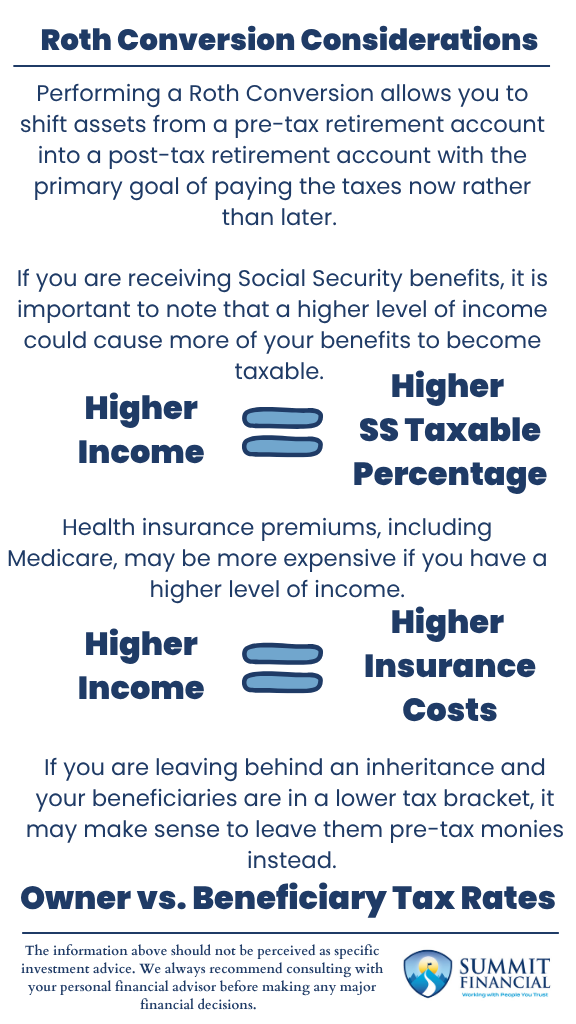

- Performing a Roth Conversion allows you to shift assets from a pre-tax retirement account into a post-tax retirement account with the primary goal of paying the taxes now rather than later.

- If you are receiving Social Security benefits, it is important to note that a higher level of income could cause more of your benefits to become taxable.

- Health insurance premiums, including Medicare, may be more expensive if you have a higher level of income.

- If you are leaving behind an inheritance and your beneficiaries are in a lower tax bracket, it may make sense to leave them pre-tax monies instead.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink, James Baldwin, and Daniel Ladzinski

Sources:

- https://summitfc.net/traditional-vs-roth-ira/

- https://summitfc.net/roth-ira-conversion/

- https://www.irs.gov/newsroom/irs-reminds-taxpayers-their-social-security-benefits-may-be-taxable

- https://www.healthcare.gov/lower-costs/save-on-monthly-premiums/

- https://www.ssa.gov/benefits/medicare/medicare-premiums.html

If you found this article helpful, consider reading: