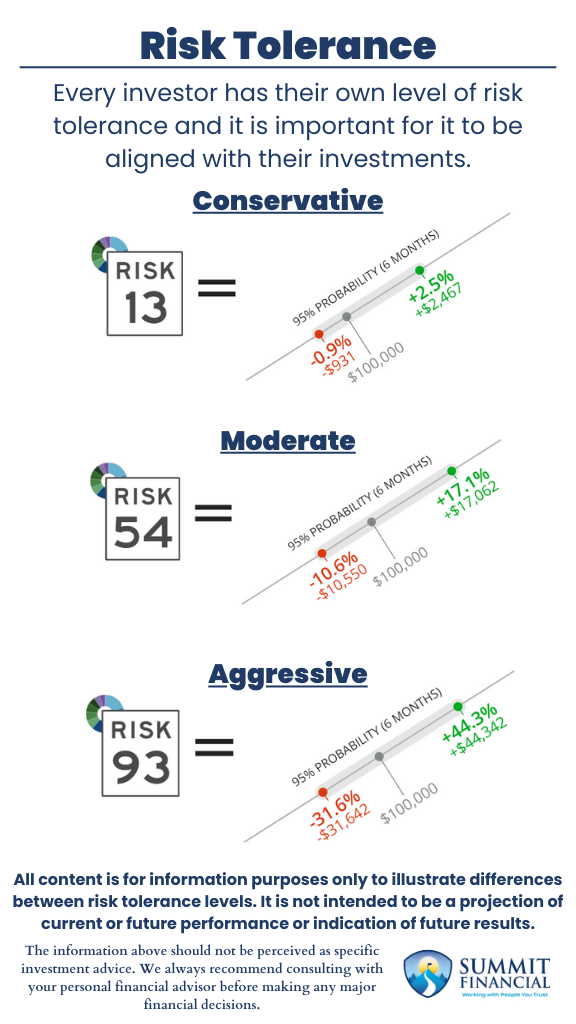

Risk Tolerance is an ongoing conversation we have with every client. Risk Tolerance can simply be defined as how much volatility an investor can handle. Volatility refers to the ups and downs in the markets and the associated investments. So, risk tolerance is used to define how much ups and downs an investor is comfortable with. Every investor has their own level of risk tolerance, and it is important for it to align with their investments.

Assessing Your Risk Tolerance

We used a questionnaire program designed to pinpoint an investor’s risk tolerance. If you want to learn your personal risk tolerance, check it out at Risk Score! This questionnaire asks for some basic starting information and then prompts the taker to answer various scenario-based questions.

For example, would you be willing to risk X amount of downside to gain Y amount of potential upside, or would you instead take a Z amount of guaranteed returns? The program will go through a handful of these scenarios until it pinpoints a risk tolerance level. The results are displayed from 1-99, with 1 being the most conservative and 99 being the most aggressive.

Understanding Investor Risk Profiles

In general, Conservative investors are willing to sacrifice upside potential for a smoother ride with less potential downside risk. These investors are typically older and either in retirement or getting close to it. They have less time to recapture any losses before funds are needed for retirement, so we sometimes recommend reducing risk to an extent as our clients approach retirement.

This can help combat the sequence of returns risk, which you can learn more about in our article Sequence of Returns Risk. Those who are Conservative sometimes tend to have less investment experience as well since they have not had the opportunities to become comfortable with larger swings in their investment accounts.

In general, Aggressive investors prefer as much upside potential as possible, even if this means the downside dips are going to be greater. They are willing to swing for homerun hits with every at-bat, even if it means they strike out more often than others. These investors are normally younger since they have more time to make up for any losses before retirement. Experienced investors are typically more aggressive since they have seen their fair share of market volatility and understand that it is part of the journey.

Moderate investors tend to fall somewhere in the middle between Conservative and Aggressive. Still, there are also those who are on the far extremes of the spectrum too that are beyond the average Conservative or Aggressive investor.

Aligning Risk Tolerance with Investments

It is important to note that risk tolerance can change occasionally for an investor based on their personal situation or recent experiences. A large loss can deter them away from a high-risk investment, as we have discussed in our recent post about Behavioral Finance. We stress to our clients that they should inform us if they feel their accounts are not allocated to their personal risk tolerance so that we can make any necessary adjustments.

Diversification is a great way to reduce some risks without potentially limiting the long-term upside of an investment. Putting all your eggs in one basket can be extremely risky, so spreading this out even a little bit can greatly impact an investor’s stress level, as we have discussed in our post about Diversification of Stocks and Diversification of Bonds.

Understanding Your Risk Tolerance – Considerations

- Every investor has their own level of risk tolerance, and it is essential for it to be aligned with their investments.

- In general, Conservative investors are willing to sacrifice upside potential for a smoother ride with less potential downside risk.

- In general, Aggressive investors prefer as much upside potential as possible, even if this means the downside dips are going to be greater.

Speak With a Trusted Advisor

If you have any questions about risk tolerance, tax strategies, our 401(k)-recommendation service, or anything else in general, please call our office at (586) 226-2100. Please also reach out if you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation.

Feel free to forward this commentary to a friend, family member, or co-worker. We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Maintaining a Long-Term Investment Perspective

- Understanding the Benefits of a Health Savings Account

- Estate Planning for Blended Households

Sources: