Net Worth is often an important topic among investors and businesses. This calculation is used to determine the value of the individual or company and is used to monitor financial progress. First, net worth looks at the overall financial picture.

This is calculated by subtracting the liabilities owed from the owned assets; the rule applies to an individual, family, business, or corporation. This calculation can also apply to the value of a country.

Additionally, this equation can capture a snapshot of the financial strength of the underlying entity. If you have been following our recent blog postings, you may have noticed we have focused on providing clarity on Dividends and Capital Gains Tax.

As part of our Personal Financial Planning 101 series, this article will cover calculating net worth.

How to Calculate Net Worth

To better understand net worth, it is essential to consider the calculation used to determine the value of the individual or company. For example, if someone has $500,000 in cash at the bank but has a personal loan for $100,000, their net worth would be $400,000.

The Role of Assets and Liabilities in Net Worth

Homeownership is a standard variable that is involved in the individual calculation. Homeowners typically have assets in the form of their home and liabilities in the form of the mortgage.

If we take the previous example and add a $300,000 home with a $200,000 mortgage, their net worth would increase by the $100,000 ownership. Add this to the $400,000 above, and the total net worth becomes $500,000.

Why Net Worth Matters for Financial Planning

Your net worth can be thought of as a barometer to measure your current financial status relative to others and where you want to be. A higher net worth typically means a stronger financial position. An investor may try to grow their net worth by two methods.

They either need to increase the value of the assets they own or decrease their debt. Either of these actions would result in a higher net worth.

When Decreasing Net Worth Can Be Beneficial

If net worth is decreasing, this typically means the financial strength of the individual or business is weakening. That is not always true, though.

For example, taking on a mortgage would increase liability, which would decrease the total net worth. At that moment, the financial strength is weakening, but the gradual homeownership and price appreciation may cause the home purchase to be beneficial in the long run.

This example proves that while net worth is essential and a common calculation, it may be misleading, and sometimes reducing net worth may lead to an overall gain.

Summary: How Net Worth is Calculated

In summary, understanding how to calculate your net worth is an essential step for most investors. There are a few key factors to consider:

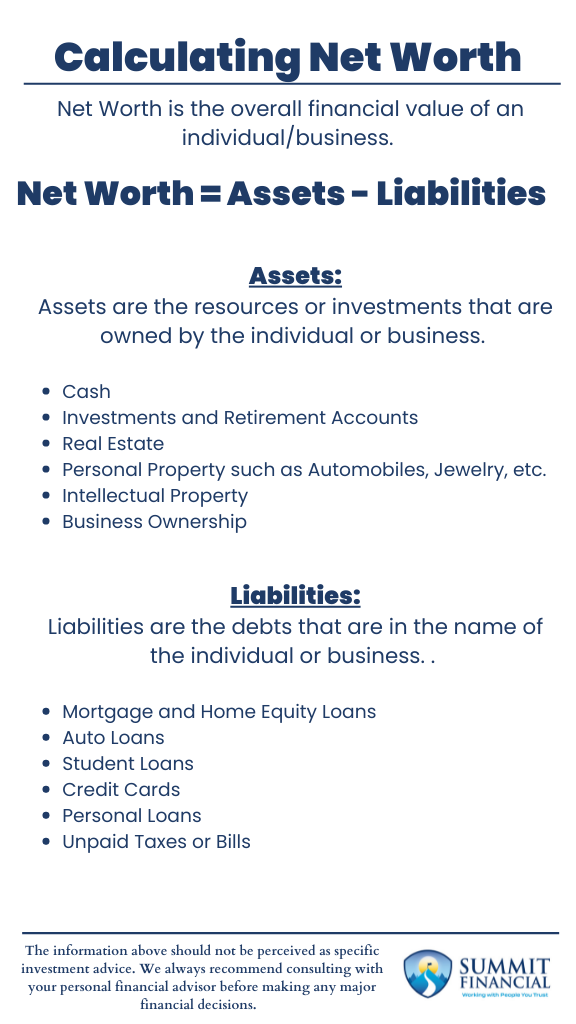

- Net Worth is the overall financial value of an individual/business.

- Assets – Liabilities = Net Worth

- Assets are the items or investments owned by the individual or business.

- Liabilities are the debts in the name of the individual or business.

Financial Planning and Review Meeting

If you have any questions about budgeting for a home purchase, your investment portfolio, taxes, retirement planning, our 401(k)-recommendation service, or anything else in general, please call our office at (586) 226-2100. Please also reach out if you have had any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation.

Feel free to forward this commentary to a friend, family member, or co-worker. We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Debt Repayment Strategies

- How to Negotiate a Raise

Sources: