There are a lot of factors to consider when an employee is separated from employment or if they are planning to change jobs. One of those factors is health insurance coverage for themselves and their family members. We’ve previously covered the basics in this article, and our team at Summit Health Services is available to assist if any of our clients ever find themselves in this situation.

SHS’s team of agents can discuss the options that are available and help clients find a solution that works for their specific needs. You may reach them at (248) 779-1000 if needed.

COBRA: Keeping Your Existing Coverage

We believe one of the first coverage options to consider is COBRA insurance through the previous employer, if available. COBRA refers to the Consolidated Omnibus Budget Reconciliation Act, which requires employers with 20+ employees to offer the continuation of their health insurance.

However, it is important to note that COBRA coverage can only be utilized for a specific period of time, such as 18 months for terminated employees or up to 36 months for the death of a covered employee (usa.gov).

We believe one of the benefits of electing COBRA is due to the fact that your health coverage would continue under the same plan. This could be a very important factor to consider for those who have already paid a decent amount towards their deductible or out-of-pocket maximum.

Choosing a different health plan could reset these limits and may lead to more out-of-pocket expenses for the remainder of the year. The premiums for the COBRA health coverage would be paid for by the employee and may or may not be cheaper than other options available.

We have seen some instances where clients have a fairly low premium for COBRA coverage, but we believe this is more common for larger employers, since they could be getting a reduced premium amount, since the group is buying coverage in bulk and could be getting a discount from the carrier.

Marketplace & Medicaid: Exploring Individual Coverage Options

If COBRA coverage is not available or if the cost is not affordable, the next option would be to review Marketplace plans. Losing qualifying coverage, such as an employer provided plan, would open a Special Enrollment Period for the employee to purchase individual coverage.

Marketplace plans can vary in benefit coverages and also premium amounts. However, depending on the household income, individuals or families may qualify for premium tax credits to help lower the monthly cost of coverage (healthcare.gov).

Lastly, Medicaid may also be an option to consider for those who meet the financial requirements and Healthcare.gov can help determine whether or not Medicaid eligibility is achievable.

Short-Term Health Plans: A Temporary Bridge

Another option to consider would be a short-term health insurance plan. We have seen that these plans are ideal for temporary gaps in coverage when one policy ends and there is period of no coverage before a new plan would begin.

These plans typically do not cover pre-existing conditions, and there may be a list of excluded services too. We believe these are best for covering preventative care or any emergencies that may occur instead (aflac.com).

Since these plans do not cover all medical expenses and may only last for a short period, such as 6 months, we have seen that the premiums tend to be more cost-effective compared to more traditional health insurance options.

Health Insurance Options After Job Loss- Key Takeaways

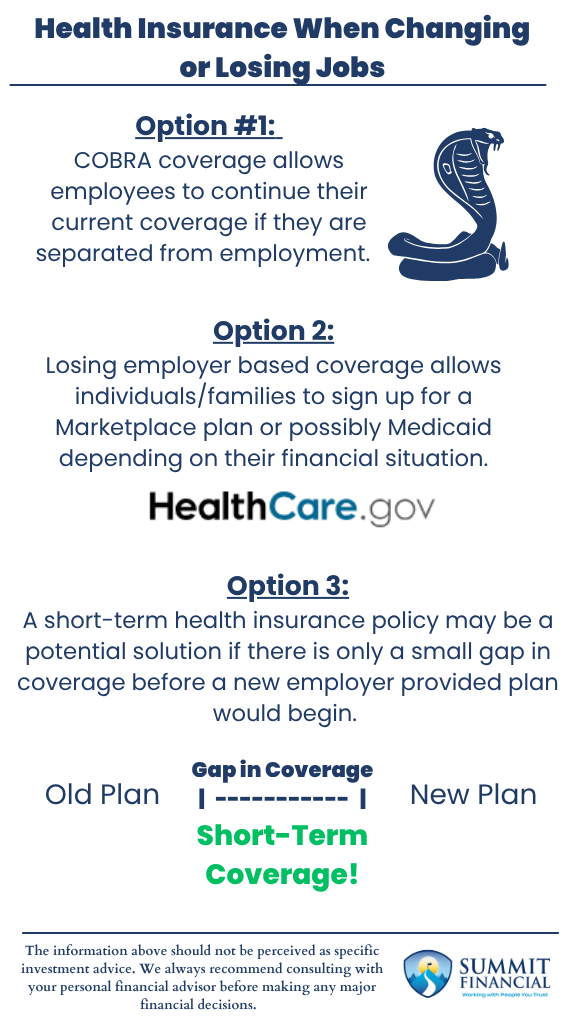

- COBRA coverage allows employees to continue their current coverage if they are separated from employment.

- Losing employer based coverage allows individuals/families to sign up for a Marketplace plan or possibly Medicaid depending on their financial situation.

- A short-term health insurance policy may be a potential solution if there is only a small gap in coverage before a new employer provided plan would begin.

Speak With a Financial Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have experienced any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please call us so we can discuss them.

We hope you learned something today. If you have any feedback or suggestions, we would appreciate hearing them.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink, James Baldwin, and Daniel Ladzinski

If you found this article helpful, consider reading:

- How Do Bull Markets and Bear Markets Differ

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Tax Filing Explained

Sources

COBRA Health Insurance – USA.gov

Health Insurance After Job Loss – Healthcare.gov

Short-Term Health Insurance – Aflac

Understanding the Basics of Health Insurance – SummitFC Blog