We recently sent out the latest recommendations for our employer plan advice program, so we thought this topic may be useful for our readers. Many employers offer retirement plan options to their employees, which is a great incentive to attract and retain talent. This employer provided benefit allows the employees to set aside a portion of their income into a retirement savings plan.

Types of Employer Retirement Plans

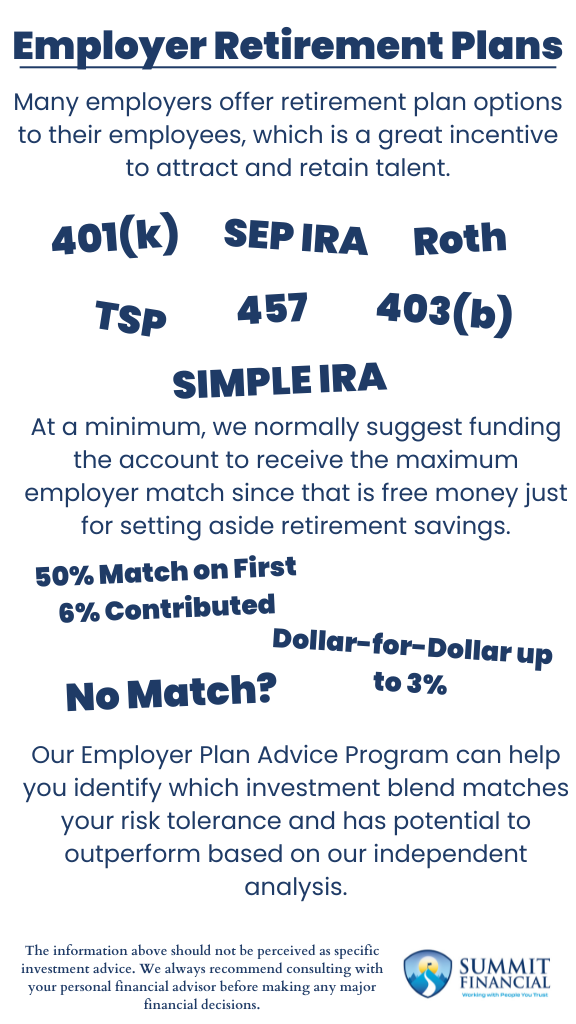

The specific plan, employer match details, investment options, etc., all depend on your employer and their decisions when establishing the plan. 401(k) plans are the most common offering, but there are also 403(b) and 457 plans for non-profit or municipal employers, a Thrift Savings Plan is offered to federal government employees, SEP and SIMPLE IRA’s are typically for employees of small businesses.

These different plan types include features that may differ from each other, such as the annual contribution limits. For example, for 2024, the 401(k) contribution limit for employees is up to $23,000, while the SIMPLE IRA limit is only $16,000 per year. So, the type of plan that is offered to you will dictate how much you are able to fund the account every year.

In addition to these, some plans may also offer the option to save on a post-tax basis via a Roth retirement plan rather than a pre-tax Traditional plan. If you are given this option, you may want to review our previous blog post that highlights the differences between the pre and post-tax retirement savings options.

Maximizing Employer Match

The inclusion of an employer match is an additional way for employers to reward their employees. This match can be set up in various ways depending on the employer’s preference. For example, the employer could match dollar-for-dollar contributions up to 3%, or maybe they will match 50% of the first 6% contributed for a total of a 3% match. These are just a couple of examples of how a match may be structured, but your employer may potentially also choose not to include a match. This match is an incentive for the employees to contribute to their retirement account and rewards them with extra contributions for doing so.

It is a great way to convince employees to save for their retirement, but it gets the employer off the hook for the contribution if the employee chooses not to fund their account. While everyone’s situation is unique, we normally recommend our clients contribute enough to receive the full employer match. This is free money that your employer is willing to contribute on your behalf simply because you chose to save for yourself, too.

Investment Options in Your Employer Retirement Plan

The list of investment options within your employer retirement plan may vary as well. For example, the Government TSP account only includes a handful of broad funds, but some employer 401(k)’s allow you to choose from the entire investment universe. We typically see that employer plans offer a handful of different stock and bond mutual funds in addition to an array of target date funds to choose from. The more options that you are given, the more you could potentially diversify within your account.

To learn more, check out our recent posts on Stock Diversification and Bond Diversification.

Getting Help: Employer Plan Advice Program

Choosing your preferred investment options can be a stressful and confusing process for some, which is why we offer our employer plan advice program.

The employer plan advice program allows us to provide quarterly recommendations to our clients for their employer retirement plans. We input all of the investment options available into our system and then perform our independent analysis. As always, we have our clients take our Risk Questionnaire so that we may consider their personal risk tolerance when drafting the recommendations.

Lastly, our advisory team discusses our expectations for the upcoming quarter to determine if any adjustments to the allocations need to be made. There are times that we will reach out proactively during the quarter to update allocations if our research says it is prudent to do so. This service helps give our clients the peace of mind that our team is taking care of their full financial picture, even their employer retirement plans.

Employer Retirement Plans- Key Considerations

- Many employers offer retirement plan options to their employees, which is a great incentive to attract and retain talent.

- At a minimum, we normally suggest funding the account to receive the maximum employer match since that is free money just for setting aside retirement savings.

- Our Employer Plan Advice Program can help you identify which investment blend matches your risk tolerance and has potential to outperform based on our independent analysis.

Speak With a Trusted Advisor

If you have any questions about how to financially prepare for parenthood, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Understanding Your Risk Tolerance

- Financial Preparation for Parenthood

- Maintaining a Long-Term Investment Perspective

- Understanding the Benefits of a Health Savings Account

- Estate Planning for Blended Households

Sources: