The rate of divorce is very high in our current society, which is likely not a surprise to anyone these days. However, one thing that may not be as obvious is the fact that Blended Households are becoming increasingly common as divorcees enter into new marriages.

A Blended Household refers to when stepparents and stepchildren enter the family dynamic, which is often the case for divorcees entering into a new marriage. These types of situations can lead to more complex estate planning needs as the couples may have children and assets from their previous lives.

Understanding the Unique Estate Planning Needs of Blended Families

We have addressed estate planning before in a couple of previous blog posts. You can learn more about Beneficiary Designations and the differences between Wills and Trusts on our website. These sources can be great reference points for those who are looking to understand the basics of estate planning. However, blended households tend to require a more complex plan due to their unique family structures.

These situations are distinctive because:

-

Spouses may prefer to leave assets to their biological children rather than stepchildren.

-

Some may even prefer not to leave the majority of assets to their surviving spouse.

According to LegalZoom, this can result in estate plans that differ greatly from those created by couples in traditional households.

Why You Should Review Your Plan After Remarriage

Every couple should review their estate planning after their marriage, whether it is their first or their third marriage (trustandwill.com).

This is an important time to review your beneficiary designations and update any wills/trusts that may already exist. It is important to have open communication about your estate planning wishes, and we believe an A-B Trust setup may be appropriate in these circumstances.

One spouse may have a lot of assets and want to make sure their kids receive these when they pass instead of a portion going to stepchildren, but they also do not want to leave their surviving spouse with no financial security.

If no estate planning actions are taken, your estate will likely proceed through probate with your surviving spouse receiving the majority, if not all, of your assets. When your surviving spouse passes, the probate judge may decide to split the assets among all the family’s children, which means your assets may be passed to stepchildren. This concern is even stronger when only one of the spouses is responsible for a vast majority of the household’s assets.

How an A-B Trust Works

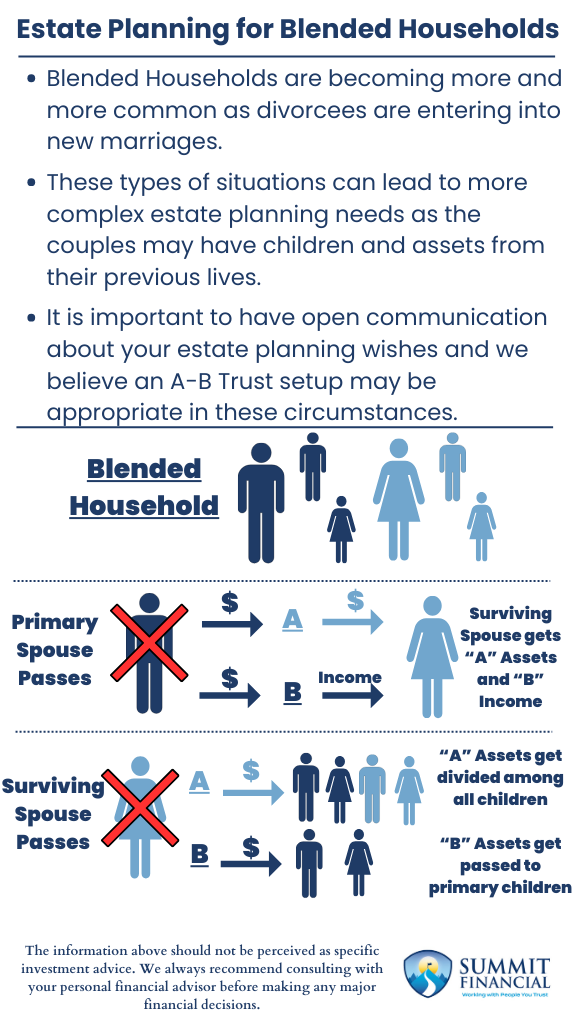

An A-B Trust may be able to provide the specific guidelines needed to accomplish this type of structure. The naming of this estate plan tool is used to reference the two trusts that will be created.

- The “A” trust will list the surviving spouse as the beneficiary, so they will receive full control and ownership of those assets when their spouse passes.

- However, the “B” trust is set up to limit the control of the surviving spouse so that they can only use the assets according to the trust guidelines.

Commonly, we see that the surviving spouse is allowed to live off the income generated from the “B” trust, or they must submit requests to the trustee to approve before assets are distributed. When the surviving spouse passes, the assets in the “A” trust may be set up to be distributed evenly among all the family children.

The “B” trust could be set up to pass the remaining assets to the children of the original owner. The “B” trust allows you to provide for your surviving spouse after you pass based on the trust guidelines, but then also makes sure that the remaining assets get passed to your children only instead of being split amongst the stepchildren too.

Communication is Key

This type of trust structure can be complex, so we recommend consulting with your estate planning attorney regarding your goals before committing to this plan. There may be other variables to consider that might make other strategies more efficient. We cannot stress enough how important it is to have effective communication with your spouse about your estate wishes.

Those who are later in life may have very valid reasons why they want to prioritize their children receiving assets, but those intentions should be clearly communicated to prevent unnecessary disagreements in the marriage.

However, we believe the A-B trust structure allows for the control and flexibility to meet these unique wishes. It may not be the best solution for everyone, but we believe it is worthy of consideration for those who are planning estates for blended households.

Estate Planning for Blended Households- Considerations

- Blended Households are becoming more and more common as divorcees are entering into new marriages.

- These types of situations can lead to more complex estate planning needs as the couples may have children and assets from their previous lives.

- It is important to have open communication about your estate planning wishes and we believe an A-B Trust setup may be appropriate in these circumstances

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have experienced any changes to your income, job, family, health insurance, risk tolerance, or overall financial situation, please call us so we can discuss them.

We hope you learned something today. If you have any feedback or suggestions, we would appreciate hearing from you.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Summit Financial Consulting LLC is not a law firm and does not provide legal advice. Please consult a qualified professional for assistance with any tax or legal issues such as wills and trusts. The information related to estate planning is general in nature and does not constitute tax or legal advice or a solicitation for any such service.

If you found this article helpful, consider reading:

- How Do Bull Markets and Bear Markets Differ

- Navigating College Funding

- Financial Planning Mistakes to Avoid

- Tax Filing Explained

Sources:

- https://summitfc.net/how-to-make-the-most-of-estate-planning/

- https://summitfc.net/beneficiaries-and-estate-planning/

- https://www.legalzoom.com/articles/estate-planning-for-the-modern-blended-family

- https://trustandwill.com/learn/estate-planning-for-blended-families

- https://www.investopedia.com/terms/a/a-b-trust.asp