What Is the Fear vs Greed Index?

There are a variety of ways that financial analysts try to predict the future movements of the markets. One strategy is to use the market’s current emotional state to forecast the next market trend. Barron Rothschild coined a famous investing quote: “the time to buy is when there’s blood in the streets.” This phrase states that the market bottom may be when Fear is at its peak, hence the potential for the Fear vs. Greed Index.

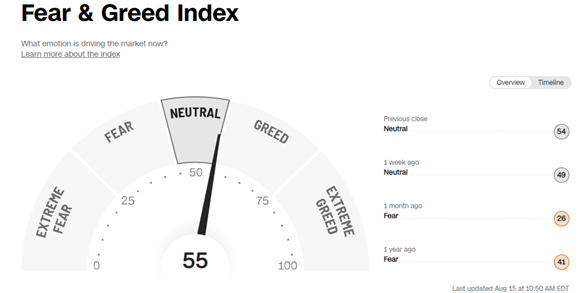

Measuring The Fear vs Greed Index

The Fear vs. Greed Index displays a blend of indicators used to gauge the current view of the financial markets. These indicators are market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe haven demand.

The result of these indicators is a reading of 0-100 with the following scale:

- 0-25: Extreme Fear

- 25-45: Fear

- 45-55: Neutral

- 55-75: Greed

- 75-100: Extreme Greed

Photo courtesy of CNN

The above snapshot is from August 15th, 2022. In the midst of the bear market, equities have received a sizable bounce for the months of July and August. You can see that a month ago, the indicator was reading Fear and has since then shifted to Neutral. The rally in equities has been accompanied by an increase in this gauge of Investor Sentiment.

Photo courtesy of Yahoo

The image above is the Fear vs. Greed index from August 2021 through August 2022 overlaid on the S&P 500 for the same timeframe.

As you can see, both have followed a similar trend over that timeframe, but the correlation is not perfect. For example, investor Sentiment was closer to a peak when the market was about to dip. Conversely, there was more Fear leading up to a market bounce.

Using Investor Sentiment to Analyze Market Trends

Investor Sentiment is only one qualitative analytical tool and should not be the sole reason for an investment decision. There is no crystal ball when it comes to the stock market, and there is no magical formula. As seen above, science is not perfect, and investor emotions can change quickly.

We believe in the weight of the evidence approach when analyzing our third-party research. This means we compare all the data and opinions before taking any investment actions. For additional information, view our previous blog comparing Fundamental and Technical Analysis.

Fear vs Greed Index- Key Findings

- Investor Sentiment may be used to potentially predict future trends in financial markets.

- The Fear vs. Greed Index displays a blend of indicators used to gauge the current view of the financial markets.

- Investor Sentiment is only one qualitative analytical tool and should not be the sole reason for an investment decision.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

If you found our article helpful, consider reading our other recent posts on Bull vs. Bear Market, Record Inflation, and Fiduciary vs. Financial Advisor.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

Sources: