Home ownership is a large financial milestone, and whether you are buying your first home or have been through this process before, there are a few budgeting tips that we want to address. These tips may help prevent surprises you may encounter, and this could allow you to remain on track for your overall financial goals.

For more general budgeting information, visit our previous blog: Budgeting 101.

How Your Down Payment Affects Long-Term Costs

First, it is important to know that the size of your down payment will have a large impact on the cost of your monthly mortgage payments.

-

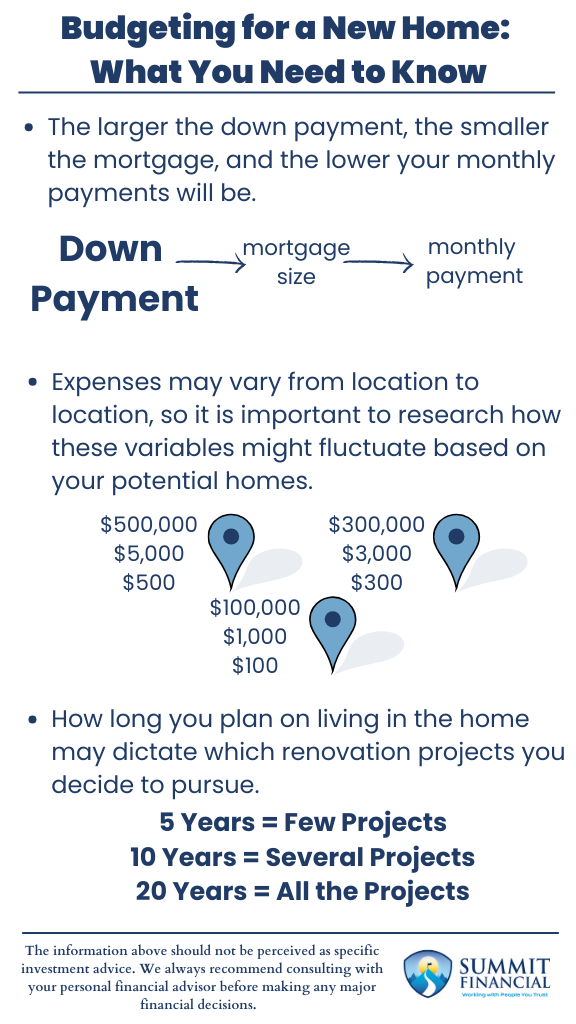

The larger the down payment, the smaller the mortgage, and the lower your monthly payments will be.

-

By making a 20% down payment, you may be able to remove PMI payments from your monthly costs.

-

Some underwriting requirements have minimums for the down payment to qualify for the loan.

It is important to identify these factors in advance so you know how much you need to save before purchasing. That will allow you to structure a more specific savings plan.

By knowing how much you need for the down payment, then you can solve for how much you need to save monthly or how long it will take to save your desired amount.

Account for Regional Cost of Living Differences

Next, knowing the cost of living in your desired location is crucial to projecting your budget after the home purchase. The average cost of living will fluctuate drastically on a national level, but it will still vary locally as well.

This is in reference to both the cost of homes in the area and the cost of consumer goods, such as grocery or gasoline prices. Lastly, property and potential city income taxes may differ between similar properties in different locations.

Other things, such as the distance of the commute to work, may increase the monthly cost of specific expenses. Of course, the interest rate associated with the mortgage loan will have a big impact on the monthly payments.

It is important to research these factors and include them in your budget projections to ensure you can still achieve your overall financial goals. For more information about general budgeting, check out our article on the basics of budgeting and financial planning mistakes to avoid.

Plan for Future Home Projects and Renovations

Lastly, there will always be home projects or renovations that are considered while you are living in the property. Sometimes these projects are necessary and need to be completed, while others are optional and are up to your preference. You can gain some insight into future projects during the home inspection when you review the condition of various home specifics, such as the life of the roof or furnace.

This time could also be used to imagine what future renovations you may voluntarily decide to pursue, such as patio or kitchen remodeling. The length of time you plan on living in the home may impact how many of these options projects you decide to complete.

For example, if you are only going to live there for 3-5 years, then you may limit the number of projects you undertake. If you plan on living there for 20+ years, then you will likely be more willing to complete those low-priority projects.

Budgeting for a Home Purchase Conclusion

- The larger the down payment, the smaller the mortgage, and the lower your monthly payments will be.

- Expenses may vary from location to location, so it is important to research how these variables might fluctuate based on your potential homes.

- How long you plan on living in the home may dictate which renovation projects you decide to pursue.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker.

If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it. We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Best Regards,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink.

If you found this article helpful, consider reading:

Sources: