There are plenty of different types of life insurance that may be available to you, so how do you know which is the most suitable? This blog will break down what we believe are the most common types of life insurance policies.

As always, everyone has a unique situation, and the best policy for your needs may be different from others, so we recommend meeting with your personal agents before purchasing a policy.

We have discussed life insurance in our previous posts on Purchasing Life Insurance and Guide to Life Insurance. These resources may elaborate on the content here, so we recommend checking out these resources as well.

Group Policies: Employer Provides Access, Coverage Depends on Terms

A Group policy is coverage offered by your employer, and terms/pricing are based on the employer’s decision-making. We often see that the base level of coverage is offered to the employee at no cost.

The employee may have the option to increase their coverage by paying the increased premium through their payroll deduction. These policies are “purchased in bulk” and this coverage may be more affordable than purchasing an individual policy, especially since group policies do not require any medical underwriting. This means Group policies can be affordable options for those employees with flags in their medical history (Investopedia).

Lastly, we have commonly seen that these policies are only available as long as you remain employed at the company, but some will allow you to continue making full premium payments to continue coverage after you have separated from the employer. All of the terms and conditions of the coverage are determined by the employer when they decide what benefits to offer their employees, so every employer group policy may look a little different.

Term Policies: Coverage Lasts for a Defined Period, Cost Reflects Duration

A Term policy provides coverage for a set period of time and typically expires after the duration of the contract. Since these policies are only offered for a set period of time, the premiums are typically much cheaper than a permanent policy (NerdWallet).

We normally recommend term insurance for those looking for coverage just to cover their main working years and do not want to carry the coverage during retirement. Coverage could be for as little as 10 years or as long as 40 years and the death benefit amount can range from as low as tens of thousands of dollars all the way to up millions of dollars.

These policies normally expire after the duration of the policy term, but some do allow you to continue the coverage with an increased premium at that point. However, the premium normally becomes so expensive that we do not commonly recommend continuing coverage.

Permanent Policies: Lifelong Coverage Continues, Cash Value Accumulates

A Permanent policy will provide a death benefit as long as you continue to pay the premiums and may also include an underlying cash value benefit. We believe these policies best fit clients who are interested in insuring their lives no matter how long they live.

This could potentially be a way to provide a tax-free inheritance instead of relying on any potential remaining savings/investments. These policies also typically contain a cash value component, which is essentially an underlying pool of money within the contract that can be used for pre-paying future premiums, used as leverage by funding a loan, or enhancing the death benefit in the contract.

There are a few different types of permanent policies such as Whole Life, Universal Life, and Variable Life. The main difference between these is the flexibility in premium payments as well as the growth associated with the cash value (Investopedia).

Final Expense Policies: Small Benefit Covers Costs, Payout Supports Planning

A Final Expense policy is typically a smaller death benefit just for covering funeral, burial, or other expenses that occur after death. We primarily see clients are interested in these contracts when they do not believe their beneficiaries will have enough money to pay for the funeral or burial when they pass.These contracts are normally relatively small since they are only meant to cover any expenses associated with the end of life (NerdWallet).

We have seen some contracts that offer expedited payments of benefits, allowing the beneficiary to avoid waiting for the estate to settle and afford a proper funeral or burial for the owner. These can potentially make the end-of-life planning process a less stressful time for the beneficiaries.

Policy Types Summarized: Each Serves a Role, Coverage Depends on Need

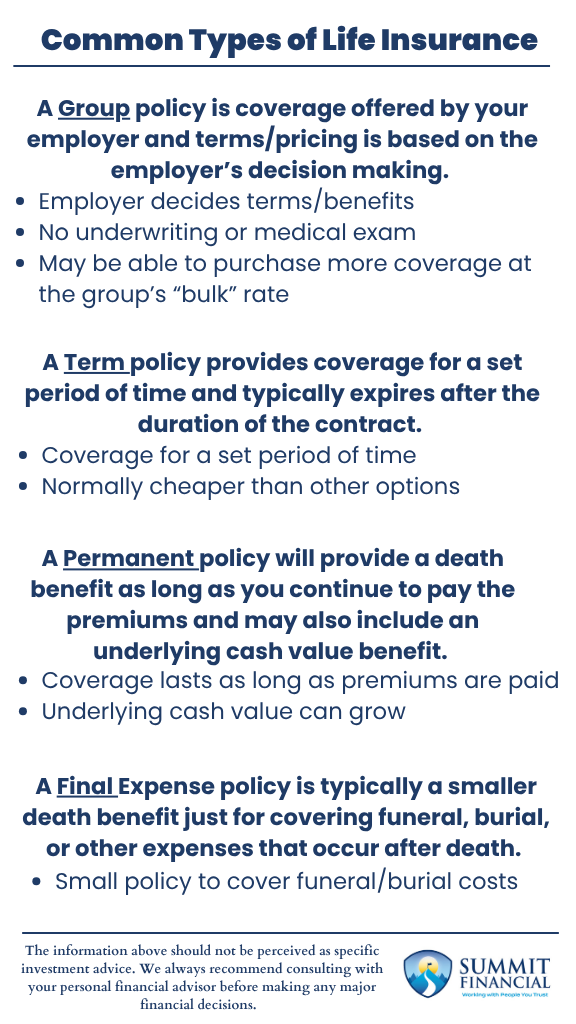

- Group policy is coverage offered by your employer and terms/pricing is based on the employer’s decision making.

- Term policy provides coverage for a set period of time and typically expires after the duration of the contract.

- Permanent policy will provide a death benefit as long as you continue to pay the premiums and may also include an underlying cash value benefit.

- Final Expense policy is typically a smaller death benefit just for covering funeral, burial, or other expenses that occur after death.

Speak With a Trusted Advisor

If you have any questions about your investment portfolio, retirement planning, tax strategies, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Sincerely,

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, James Wink, James Baldwin,

If you found this article helpful, consider reading:

- How Do Bull Markets and Bear Markets Differ

- Navigating College Funding

- Financial Planning Mistakes to Avoid

Sources

-

Types of Life Insurance Plans and How to Decide Which One is Right for You

Source: Investopedia -

Group Life Insurance Definition and Overview

Source: Investopedia -

Understanding the Different Types of Life Insurance

Source: NerdWallet -

Purchasing Life Insurance: Key Considerations

Source: Summit Financial Consulting -

A Guide to Life Insurance

Source: Summit Financial Consulting