We wanted to take this opportunity to refresh our mindsets and explain what we believe is required to achieve a high net worth status. 2024 is in full swing, and each day seems to be busier and busier. It is important not to fall victim to life’s craziness and to remain committed to your long-term goals, whether personal or professional.

This blog post aims to provide educational insights into our observations about common habits among high net worth individuals. While everyone’s financial situation is unique, we hope this information will be valuable in your own process.

To support your financial planning efforts, it may be helpful to review our post on Financial Mistakes to Avoid. This content should provide a good starting point and includes a few areas of concern where you should try to avoid making mistakes.

1. Multiple Paths to Wealth

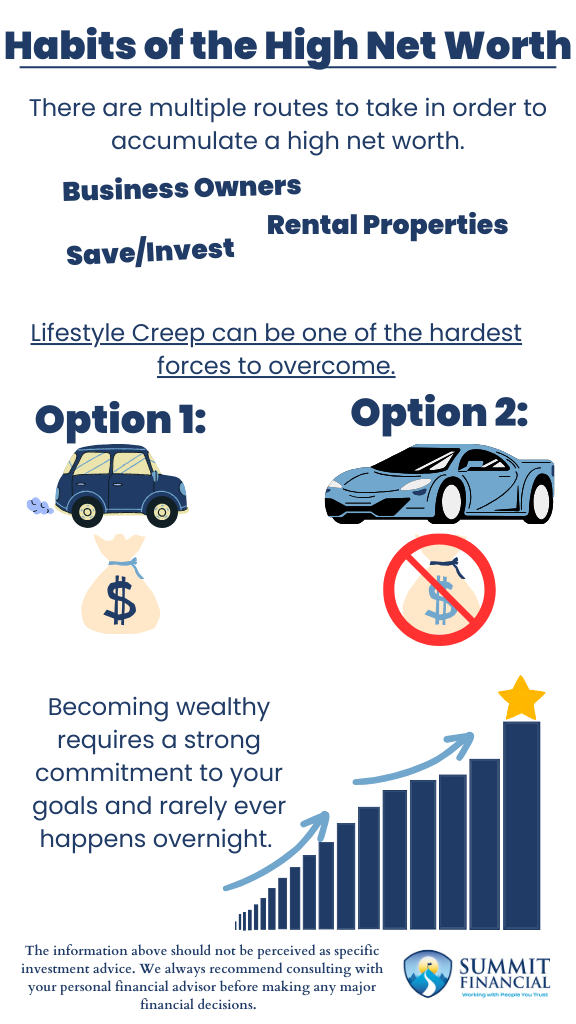

First, we want to be clear that multiple routes can be taken in order to accumulate a high net worth.

We have clients who have accumulated their wealth by being small business owners. Some own various rental properties, but most have saved and invested their way to a high net worth. Building wealth is not a one-size-fits-all strategy. Depending on your career path and risk tolerance, some options may be more suited to you than others.

For a deeper dive, check out our previous blog post recommending some insightful personal finance books, that are worth reading. Some explain this thought in deeper detail.

2. Spend Less Than You Earn

However, there is one factor that we believe is required in order to build wealth: you must spend less money than you make and use the excess cash flow for accumulating assets.

The assets could be growing your business, buying rental properties, funding retirement accounts, etc., but accumulating assets typically requires excess cash flow. If your monthly bills are higher than your monthly income, you are likely in debt and struggling to get out of the hole.

If you cannot save a portion of your income, you will continue to struggle to buy assets that may appreciate in value or provide additional income streams. Budgeting is always the main foundation of a strong long-term financial plan.

3. Beware of Lifestyle Creep

In addition to budgeting concerns, we want to address the issue of Lifestyle Creep.

The Lifestyle Creep concept is that household or personal expenses tend to rise as income rises. For example, those who receive a generous raise may buy a new car or a bigger home. An annual bonus may be spent on a nicer vacation or buying new jewelry.

This is concerning because this additional income could be used to purchase more assets rather than fund consumption. A pay raise is a great way to receive more excess cash flow, but that is only possible if your expenses do not increase. We have seen many high-net-worth clients who have lived frugal lives, which allowed them to save and invest their way to wealth.

Which scenario do you believe is wealthier? (Assuming all other relevant factors are the same.)

- An individual who drives a 10-year-old Toyota has $100,000 of invested assets.

- An individual who drives a new Corvette but does not fund any investments.

Option 1 is more likely to build wealth! This is an example of how living frugally and living below your means can allow you to save/invest to build wealth. Option 2 is a high spender who does not feel the need to save on a monthly basis. Of course, Option 2 may still find their way to success, but it will be a longer and more challenging route compared to if they decided to keep expenses low.

4. Long-Term Financial Planning

By working with our client base, we have seen that it is very common that building wealth is a long-term plan. It requires an efficient financial plan and dedication to the plan to ensure things remain on track.

Please note that we are aware that there are some individuals who become highly paid professionals or business owners, receive a large inheritance, or even win the lottery.

We do not think these low-likelihood events should be considered part of the typical financial plan, but they can help your situation if you find yourself in one of these instances. It is very unlikely that the average individual will become wealthy overnight, and wealth is more likely built by a long-term commitment to your goals.

Disciplined Habits of the High Net Worth – Considerations

- There are multiple routes to take in order to accumulate a high net worth.

- Lifestyle Creep can be one of the hardest forces to overcome.

- Becoming wealthy requires a strong commitment to your goals and rarely happens overnight.

Speak With a Trusted Advisor

If you have any questions about successful financial habits, tax planning, our 401(k) recommendation service, or other general questions, please give our office a call at (586) 226-2100. Please feel free to forward this commentary to a friend, family member, or co-worker. If you have had any changes to your income, job, family, health insurance, risk tolerance, or your overall financial situation, please give us a call so we can discuss it.

We hope you learned something today. If you have any feedback or suggestions, we would love to hear them.

Zachary A. Bachner, CFP®

with contributions from Robert Wink, Kenneth Wink, and James Wink

If you found this article helpful, consider reading:

- Understanding Your Risk Tolerance

- Financial Preparation for Parenthood

- Maintaining a Long-Term Investment Perspective

Sources:

- https://summitfc.net/recommended-personal-finance-books/

- https://summitfc.net/financial-planning-mistakes/

- https://summitfc.net/budgeting-101/

- https://www.investopedia.com/terms/l/lifestyle-creep.asp#:~:text=Lifestyle%20creep%20refers%20to%20the,a%20necessity%20versus%20a%20want